charitable gift annuity tax reporting

Its then deductible resulting in a wash. Charities must use the gift.

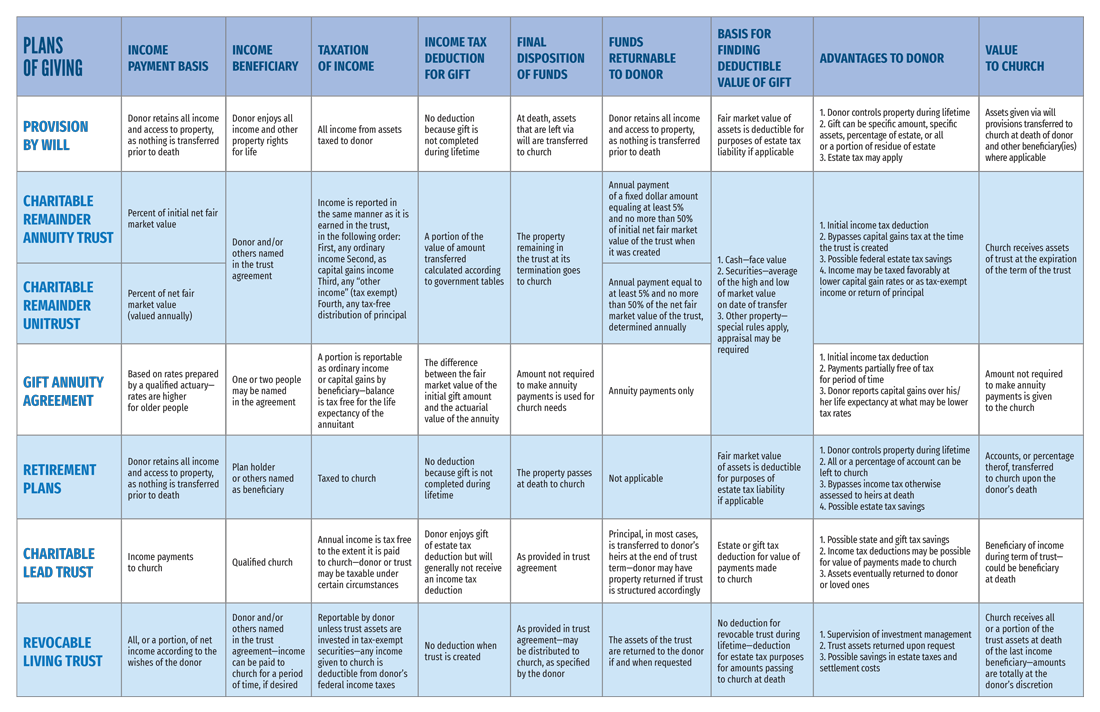

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

. You deduct charitable donations in the FederalDeductions CreditsCharitable Donations section. Or select the magnifying glass icon in the upper left and enter charitable. The charitys gift is a present interest gift and is reportable if it exceeds the 13000 annual exclusion.

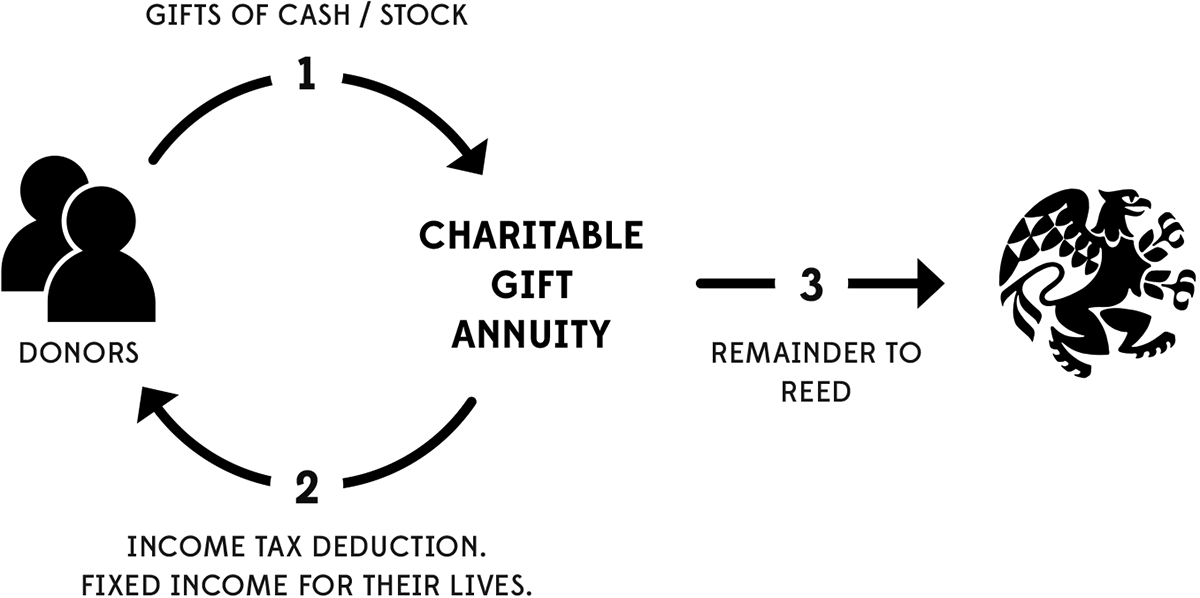

With a charitable gift annuity you have the potential to take a partial income tax deduction when you fund the annuity. New Look At Your Financial Strategy. Additionally the donation itself is tax-deductible.

Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. The charity that issues the annuity will send a Form 1099-R to the annuitant each year.

Send the Gift Annuity Application to the charity_office office at The CFMC. Get this must-read guide if you are considering investing in annuities. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Ad Annuities are often complex retirement investment products. 11 Little-Know Tips You Must Know Before Buying. The payments you receive from a charitable gift annuity are tax-free and can help supplement your retirement income.

Donors who fund an annuity with appreciated property must also report a certain amount of capital gain income. While charitable gift annuities can provide an initial tax deduction youll still owe tax on some of the lifetime payments you. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

53808 of 60000 of capital gain is 32285. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. As with any other.

Dont Buy An Annuity Until You Review Our Top Picks For 2022. 14122021 Proof charitable gift annuity tax reporting of Charitable Contributions. Up to 25 cash back If you and your spouse create a gift annuity together the rate is based on your combined statistical life expectancies.

This form will specify how the payments should be reported for income tax purposes. Taxation of Annuities Funded with Cash If a donor makes a gift. Substantiation required by the Internal Revenue Service for a taxpayer to claim a donation of.

For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate of 78 paying 780 annually for the. If the value of the interest exceeds the 13000 annual exclusion and the gift is not offset by the 5120000 for 2012 unified gift and estate tax exemption gift tax will be due. If you are using a check to fund the gift enclose your check with the application.

Ad True Investor Returns With No Risk. A charitable gift annuity CGA is a contract under which a 501c3 qualified public charity in return for an irrevocable transfer of cash or other. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Download a PDF of this article. This is the amount that should be reported on Form 8283 as a charitable deduction. Find Out How With Our Free Report Get Facts.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. The short answer is that the Internal Revenue Code IRC requires charitable donations to be reported on the gift return if a combination of gifts to charities and other. A quick way to see that this requirement has.

Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. Learn some startling facts. A charitable gift annuity is a form of planned giving that is set up by way of a contract between a donor and a specific charity.

Palmers capital gain is reportable because that is the percentage attributed to the purchase price of her annuity. The minimum required gift for a charitable gift annuity is 10000. The deduction amount is based on several variables.

Shortly after your application is. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study.

Later when you start receiving the annuity payments you will receive a 1099-R from. Under that contract the donor gives cash or other property to the. Visit The Official Edward Jones Site.

The IRS requires that the value of the annuity given to the donor must be less than 90 of the value of the gift the donor gives to the charity. How Are Charitable Gift Annuity Payments Taxed. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Charitable Gift Annuity. 53808 of Ms. For a 55-year-old with a 60-year-old spouse the.

282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Asbury First United Methodist Church Home

Change Of Address Checklist Real Estate Seller And Buyer Etsy Change Of Address Checklist Listing Presentation

Estate Planning Checklist Estate Planning Checklist Funeral Planning Checklist Funeral Planning

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Tax Tip 20 Estate Planning Tax Advisor Tips

Recent Developments In Estate Planning Part 1

Planned Giving Charitable Annuities Trusts Princeton Theological Seminary

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

City Of Hope Planned Giving Annuity

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Life Income Gifts Giving To Reed Reed College

Charitable Gift Annuity Rates On The Rise Don T Miss This Opportunity To Make A Difference University Of Maine Foundation